Franking charges: All you need to know

When you purchase a home, you must pay a variety of fees to the government and enabling officials in the form of tax breaks. Stamp duty and registration fees are included in this. Also there is a cost known as franking charges that must be paid during the property sale. Whereas many individuals mix up stamping with franking, the two are essentially distinct. Please explain franking to us in detail.

What are Franking Charges?

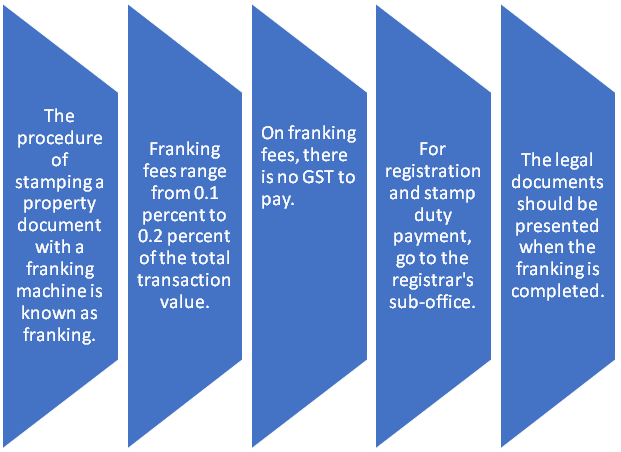

What is the meaning of franking in a bank? The procedure of stamping a property document with a franking machine is known as franking. Only authorized banks and agencies can facilitate the franking procedure via stamping your legal documents or affixing a specific denomination that serves as confirmation that the stamp duty for the transaction has been paid. The authority for stamping your paper will charge you a franking stamp fee. Franking fees often amount to 0.1 percent of the entire purchase price.

In other terms, a franking charge is a cost that must be paid to a bank or government agency in exchange for stamping property paperwork that serve as legal proof of stamp duty payment.

Differences Between Franking and Stamping

Stamp duty is a payment paid to the government in exchange for the government’s approval of a property transaction, although franking paperwork or franking paper refers to the process of having these legal property papers stamped.

| Stamp Duty | Franking Charges |

| Stamp duty is a government levy placed on property documents like sale deeds and asset or property transfers. | Franking fees are a small fee paid to an authorized bank or agent for stamping or attaching the denomination on an agreement instrument. |

| Vary by state, stamp duty ranges from 4% to 6%. | Although franking stamp paper is normally free, banks may charge up to 0.1 percent of the transaction value, that can be deducted from the stamp duty paid. |

| Stamp duty can be paid in person at the sub-office registrar’s or digitally through the state’s website. | Authorized banks are the only ones who can frank stamp paper; however they have a limited franking quota, thus they can only do it during particular hours of the working day. |

Franking Charges for Loan Agreements

Franking is also required for lending agreements. Beyond the property document charges, a 0.1 percent franking charge would be required to be paid on the loan agreement. Which implies that at the very least 0.2 percent of your budget will be spent on document authentication.

What is the franking procedure?

When all of the clauses and needed material are written on a blank piece of paper and the documents are ready to sign, they are referred to as franking. The applicant must submit the application together with the franking information. After the legal documents have been franked by authorized banks and agents, they must be given to the sub-office registrar’s for registration and stamp duty payment.

Future of Franking in India

Due to the obvious convenience and legitimacy that e-stamping provides, franking may be totally superseded by e-stamping in the future as more states embrace it. According to latest stories, the Karnataka government may soon end physical franking of documents and make electronic stamping mandatory for the implementation of tools such as sale agreements, mortgages, and title deeds, in order to prevent stamp duty and franking scams, which have a negative impact on the state’s revenue.

Disclaimer: The views expressed above are for informational purposes only based on industry reports and related news stories. PropertyPistol does not guarantee the accuracy, completeness, or reliability of the information and shall not be held responsible for any action taken based on the published information.