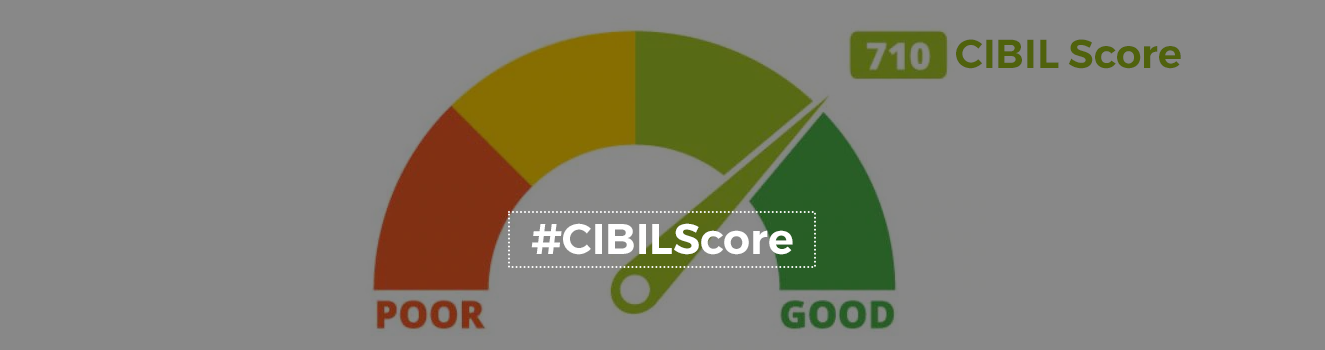

How to get your CIBIL Score right in 2020

Entering into a new decade, evaluating your financial score is natural. One needs to consider what he wants the next decade to bring in, whether it’s a new car, a house, or a trip abroad. Certain loans or credit cards may help you with it. This is where your credit score will likely play a crucial role.

Tips to improve and maintain good CIBIL SCORE

Maintaining a good CIBIL score is very important since it is checked by every financial institution before processing any loan, credit card or opening any account. Check these tips on how to improve and maintain your CIBIL Score:

- Clearing your credit card dues: Unpaid outstanding amounts acquired over a while damages your credit score and increases your interest. Try clearing out all the outstanding balance by taking a loan or by borrowing from friends or family members to clear the dues.

- Use the oldest credit card to maintain credit history: An old credit card account maintained over a long period of time with a good repayment track can boost your credit score. Your old credit card also carries the proof of your repayment and borrowing history over a longer period of time. Ex. a credit issued in 2005 can improve financial credibility overtime.

- A loan with longer tenure: If you plan to avail for loan, opt for a longer tenure and try making timely payments. This can give a positive boost to your credit score.

- Maintain balance in using the credit limit: Ask for a higher credit limit from the banks and try to keep low utilization. On the use of your credit limit, your score may change slowly. High usage of the credit limit is an indication that your income does not satisfy your expenses.

- Raise dispute immediately to report inaccuracies: If you find any errors in your CIBIL report about loan repayment closures made or any errors in your financial accounts, raise a dispute with the concerned bank or the lender immediately. You may have to follow the bank’s grievance redressal mechanism.

A good credit score allows you to bargain for lower interest rates on loans and also you may get good deals and offers on credit cards. One can check the CIBIL score by visiting www.cibil.com, you need to enter your details such as PAN number, date of birth, etc. and make fee payment to access your credit report. This credit score acts as a background check to ensure that a customer is not tempted to do any financial misappropriation. RBI empowers you to get one free Credit Information Report(CIR) every year. While getting a home loan sanctioned, CIBIL scores play an indispensable part. Lenders need to know if an applicant is creditworthy or not. For lenders, nothing proves to be more reliable than a good CIBIL. A low score always weakens the chance of getting a hasslefree home loan.

Disclaimer: The views expressed above are for informational purposes only based on industry reports and related news stories. Propertypistol does not guarantee the accuracy, completeness, or reliability of the information and shall not be held responsible for any action taken based on the published information.