Busting all the myths of home loans

A house loan is a financial service that is offered by financial institutions such as banks and housing financing firms. It is one of the most important debts that you may incur in your lifetime. As a result, it is critical that you make well-informed choices when taking out a home mortgage loan.

When making a financial choice, be sure there is no room for misunderstanding or errors since you will be living with this decision for a major portion of your lifetime. As a result, here are some common house loan misconceptions to ensure that you don’t make any costly mistakes while taking out this high-value loan.

Loans with low-interest rates are the best

It is true that every applicant would like to have the lowest interest rate possible on their house loan, but this is not always possible. The interest rate is set by the lender and is based on a variety of variables such as your credit score, income, and credit repayment history, among other considerations.

The second point to mention is that, although a low interest rate seems to be appealing, it may imply that you will be required to make a larger down payment. As a result, you will have to settle for a lower LTV. Consequently, you may be unable to get financing of up to 80 per cent, which is the typical level of credit provided by house loan lenders.

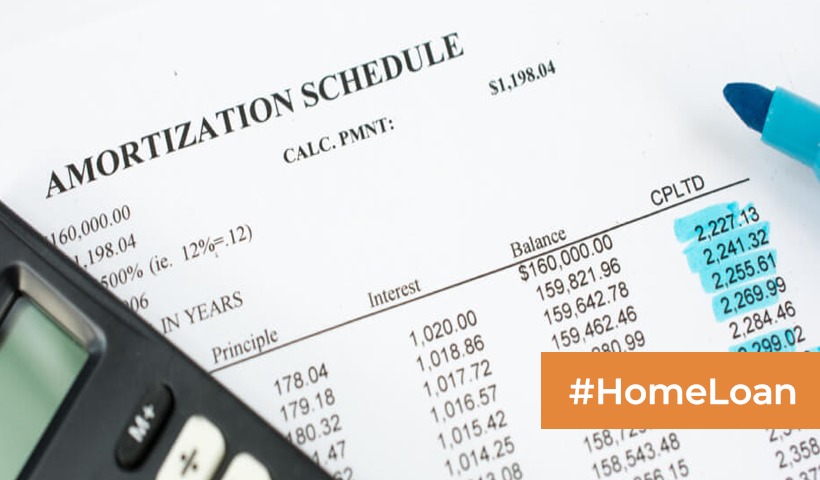

It is preferable to take out a loan with a short repayment period

A house loan is, at its heart, a long-term loan with a longer repayment period. The borrower is legally obligated to the lender for a period of up to two decades. The majority of first-time borrowers think that it is preferable to take out loans with a short repayment period. People who choose short-term loans, on the other hand, are more likely to have high Equated Monthly Instalments (EMIs).

When your EMIs are high, they may have a significant impact on your monthly budget, leaving you with little to no space to prepare for unexpected financial crises. While short-term loans can assist you in becoming debt-free at a faster rate, they are not always the most advantageous. It is preferable to take out a loan for a medium-term period at a moderate interest rate with manageable monthly payments.

If your credit scores are low, lenders will reject your loan applications

All home loan providers require you to provide your credit scores in order to process your loan. For this reason, many applicants think that if their credit score is less than 750 points (out of 900 points), their loan applications would be denied automatically, and as a result, they avoid asking for a loan altogether.

Although banks are rigorous about credit ratings, the reality is that if you contact an HFC for a house loan, you have a better chance of being accepted for the loan. Despite the fact that HFCs are prepared to make accommodations for borrowers with poor credit ratings, they do so at the expense of higher interest rates.

Fixed interest rates are preferable than variable interest rates

Many borrowers choose fixed interest rates over floating interest rates because they believe they are more stable than fluctuating interest rates. Since the market is unpredictable, they think that it is best to stay with fixed interest rates rather than variable interest rates. Although floating rates are usually preferable, they are not always so.

First and foremost, the variable interest rate is typically 1.5 percent to 2 percent cheaper than the fixed interest rate, resulting in significant savings over the course of the loan’s full term. Two points to consider: even if the interest rate varies, the consequences are rarely long-lasting, and the rate is usually changed within a month. If you choose a variable interest rate over a fixed interest rate, you may save a significant amount of money.

Lenders impose prepayment fees if the loan is paid up before the term of the loan

While lenders used to impose prepayment penalties when foreclosing on a house loan before the loan’s term had expired, this is no longer the case. Prepayment penalties on variable interest rate house loans have been prohibited by the Reserve Bank of India (RBI) for all banks and housing finance companies (HFCs). Even in the case of fixed-rate loans, lenders are prohibited from collecting any prepayment penalties after a set number of years (typically five years). It is possible to close out your mortgage without fear of incurring any penalties for paying it early on.

The misconceptions about house loans listed above are the most common ones. Due to the fact that it is a long-term commitment, it is necessary to be aware of the key details of the product in order to make an educated choice.

Disclaimer: The views expressed above are for informational purposes only based on industry reports and related news stories. PropertyPistol does not guarantee the accuracy, completeness, or reliability of the information and shall not be held responsible for any action taken based on the published information.

Hi your blog is worth appreciating and it has a lot of useful information.BLR group is one of the best home loan providers in Bangalore. The company has been in the financial services industry for many years and has earned a reputation for providing reliable and affordable home loan services. The BLR group offers a range of home loan products that cater to the needs of different customers, including first-time homebuyers and those looking to purchase a second home.

For more information visit our website : https://blrgroupservices.in/home-loan-services-best-home-loan-provider-in-bangalore-blr-group-services.html