News: Dubai’s Luxury Property Market Is Cashing in on the Global Slowdown

The emirate’s phenomenal growth is luring a horde of extravagantly rich customers. In March, Indian billionaire Mukesh Ambani sold an $80 million house in Dubai for his youngest son, setting a new record for the city’s real estate market. A few weeks later, a different customer paid 302.5% ($82.4%) million for an eight-bedroom, 18-bathroom property on the city’s artificial tree-shaped island of Palm Jumeirah.

That file could also be destroyed within a few months. Ambani this week forked out $163 million on another property on the palm-shaped island, according to those in the know, underscoring the steadily rising demand for real estate in Dubai. Brokers and developers provide information on quick market transactions, more than 70% of which include coins. And of a diverse range of customers, from affluent Russians looking for a haven for their money following their nation’s invasion of Ukraine to startup entrepreneurs and merchants from nearby Gulf countries flush with cash following the rise in oil prices.

The highest gainer on Knight Frank’s global index, which focuses on a city’s most luxurious and expensive residences, often the top 5% by market price, the emirate’s top real estate costs increased 70.3% during the three hundred and sixty-five days through September. This is significantly higher than the index’s growth rates of 2.5% in London, 8.9% in Paris, and 7.3% in New York, where offerings were constrained by higher hobby costs and energy-related economic slowdowns.

The improvement has been amazing. A little more than ten years ago, the town’s market for goods failed. Now, Dubai, which is a part of the United Arab Emirates, is at the epicenter of one of the biggest lux housing booms in history. A significant international economic watchdog put the UAE on its grey list this year, in part due to concerns over potentially illicit foreign money entering the real estate sector. Some builders still owe banks billions of dollars. The government claims it has improved consistently at tracking cash inflows and has taken actions over time to prevent future fluctuations in the advance rate.

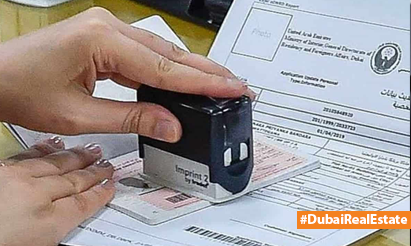

However, Dubai’s property registration is private, and the Land Department seldom grants access to information regarding the owners of specific properties. Some opponents claim that because of the financial benefits of the price range flooding into the property market, the government has no motivation to increase regulation or transparency excessively. According to Jodi Vittori, a non-resident student at the Carnegie Endowment for International Peace who has studied the emirate’s real estate market, “Dubai is a clean environment to browse for real estate extremely discreetly.”

Money seems to float in and out of every global crisis, occasionally approved shamelessly, as with Covid, but occasionally not at all, as with the Russian conflict. In either case, it will continue to play a significant role in their strategy for financial progress.

Disclaimer: The views expressed above are for informational purposes only based on industry reports and related news stories. PropertyPistol does not guarantee the accuracy, completeness, or reliability of the information and shall not be held responsible for any action taken based on the published information.